Cryptocurrency Market: June 2025 Bitcoin, Ethereum, Altcoins

In the cryptocurrency market as of June 6, 2025, major coins exhibited renewed volatility. For example, Bitcoin dipped about 4% to just under $101,000 before rebounding above $104,0000. Ethereum likewise fell toward $2,385 intraday and then rallied back into the mid-$2,400s12. Overall, the global crypto market capitalization is around $3.27 trillion, with about $106.5 billion in 24h volume3. This places Bitcoin’s dominance near 63.75%4, meaning large-cap moves tend to steer the market. (For broader context, investors also watch global stock market trends which can influence crypto.)

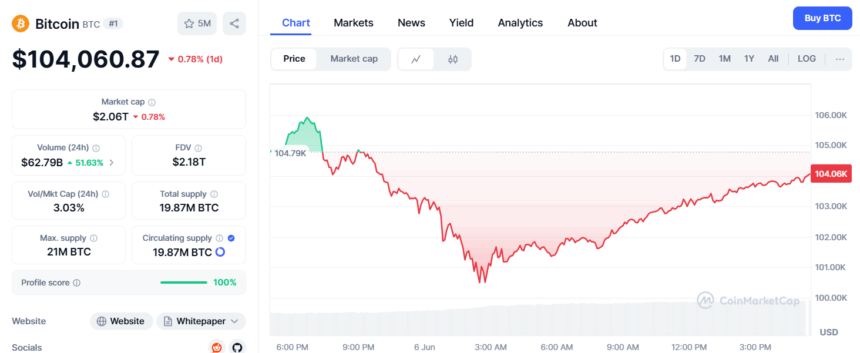

Bitcoin (BTC) Market Update

Bitcoin’s price hovered around $104,000 on June 65, after briefly touching the $100,500 mark during a sell-off6. CoinMarketCap reports BTC at roughly $104,957 (up ~2.4%) at the time7. Traders note key resistance near $106,000 and support at $100,000; the price holding above $100k has been seen as a bullish floor. Bitcoin dominance in the market remains high (~63.7%)8, underscoring its central role in market movements.

Ethereum (ETH) Market Performance

Ethereum (ETH) was trading near $2,488 (market cap ~$300.2B) as of this report9. The ETH price has been volatile: on June 6 it plunged from around $2,600 to a low near $2,385 and then rebounded to about $2,52010. This V-shaped recovery suggests strong buying interest at lower levels. In the last 24h ETH was up ~1.3%11 with a trading volume around $17.2B12. Analysts point to resistance in the $2,575–$2,600 zone and support around the $2,200s; breach of either level could signal the next directional move13. (Ethereum’s transaction base-fee burn from EIP-1559 also steadily reduces supply over time14, a factor that can support price in a bullish scenario.)

BNB and Solana Performance

Binance Coin (BNB) traded near $634 on June 6, down about 4.5% over 24 hours15. CoinGecko data shows BNB at $634.15 (–4.5%) on that date16. The price is approaching support around $630–$635, after falling through the 20-day EMA (~$657). If support holds, a recovery toward $650–$700 could be seen. Meanwhile, Solana (SOL) saw a sharp flash crash. CoinDesk reports SOL dropped 8.1% intraday to roughly $141.75, then buyers stepped in and SOL recovered toward $147.4017. This sharp sell-off followed by quick rebound suggests continued strong demand near $14218. Overall, SOL remains in a short-term range, with resistance around $150–$15219.

Altcoins & Market Overview

Altcoins had mixed outcomes on June 6. Key examples include:

- Dogecoin (DOGE): ~$0.182 (up +4.15%)20 – a bounce after recent lows.

- XRP: ~$2.18 (up +2.40%)21 – modest gains amid broad market fluctuations.

- Cardano (ADA): ~$0.661 (up +3.91%)22 – recovering as project developments continue.

The CoinMarketCap top-100 index (excluding stablecoins) was slightly down (~–1.9%) over 24h as of this date23. Remember that stablecoins (e.g. USDT) continue to dominate trading volume (~95.5% of 24h volume24), reflecting a cautious positioning by many traders. In total, major cryptocurrencies remain well above their early 2025 levels despite recent swings.

Top Crypto Trends

- Institutional Adoption and ETFs: Continued approval and inflows into Bitcoin and Ethereum ETFs are driving institutional interest in crypto.

- Regulatory and News Impact: Regulatory developments and news events (e.g. the recent Musk–Trump feud) can rapidly move prices. For example, the June 5 Musk–Trump spat coincided with Bitcoin dipping below $101k25.

- Stablecoin Dominance: Stablecoins (like USDT, USDC) account for the vast majority of trading volume – about 95% of 24h market volume26 – indicating traders are largely using crypto as a medium of transfer or hedge.

- DeFi and Layer-2 Growth: Decentralized finance platforms and Layer-2 scaling solutions are gaining traction as on-chain activity picks up again.

- Peak Trading Hours: Trading volume often peaks during certain hours (e.g. U.S. market open). For guidance, see our best times to trade crypto analysis.

- Market Cycles: Longer-term cycles can be informative. Review our retrospective on crypto market movement in 2024 to identify patterns and key levels.

FAQs

What is the current Bitcoin price and trend?

As of early June 2025, Bitcoin trades around $104,00027. It briefly fell under $101k amid recent news28 but held above key support. Today’s data shows BTC up about +2.4% over 24h29. Analysts view $100k as support and $106k as near-term resistance. Bitcoin’s market dominance (~63.7%)30 means its trend largely drives the overall crypto market.

How is Ethereum performing recently?

Ethereum is trading near $2,48831, roughly 1.3% up in the past day. It recently rebounded from lows near $2,385 on June 632, indicating buyer interest at that level. Short-term resistance is around $2,575–$2,60033. Overall, ETH remains within an upward trend that began in late May, supported by robust demand and ongoing network developments.

What are the major trends affecting the crypto market?

Key trends include growing institutional adoption (Bitcoin/ETH ETFs), evolving regulatory clarity, and market sentiment driven by news events. Stablecoin usage is very high – they account for about 95% of daily volume34. Volatility from events (e.g., the Tesla/Trump saga) also moves prices35. Decentralized finance activity and Layer-2 solutions are another rising trend. For broader context, see our analysis of global market conditions and last year’s crypto cycle (crypto market movement 2024).

Where can I find more detailed crypto market analysis?

We regularly publish related content. Check our posts on global stock market trends, daily coin prices (Crypto Market Today: Top Coins Price), optimal trading times (Best Times to Trade Crypto), and historical crypto market movements in 2024 for deeper insights.

0 Comments